property purchase tax in france

There are a number of automatic calculators on-line that can be used to obtain an estimate of the fees taxes and other charges for which you will be liable. Youll also need to pay stamp duty when buying a.

Hidden Costs Of Buying Property In France Things You Need To Consider

There is some variation in the level of the taxes depending on the department in which the property is situated.

. Estate agents are commercial entities so they will set their own sliding scale of fees - which can be anything between five and ten percent of the sale price. Enjoy your new French home. Sales tax when buying a French property Stamp duty.

Buyers in Paris will have to pay stamp duties on the purchase according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in the UK. Stamp duty is a tax on buying a house. Apartments Villas Houses for sale.

Non-residents are liable on French real estate including rights over property situated in France. These are as follows. When purchasing an existing property the buyer pays about 75 of its price in notarial expenses.

Calculating Fees and Taxes for Buying Property in France. Ad 100000 properties in France fully translated in English. 6500 17000 1627.

In a very small number a lower rate of 509 applies. Well walk you through all the different taxes in France from income tax and social charges to property taxes capital gains tax wealth tax and VAT TVA. In France there are two property taxes to pay Taxe dHabitation and Taxe Foncière both are forms of a council tax.

Any owner of real estate in France on 1 st January of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax. Property Tax in France Land TaxTaxe foncière. The taxe dhabitation is an annual residency tax which is imposed on the individual who is.

These include state duties taxes due diligence costs and the notary fee. If you are buying or already own a property in France you will have to pay the taxe foncière property tax even if youre renting it out. Read more about the wealth property tax 3 tax LA TAXE DE 3 The annual 3 tax of the real estate value is imposed when the property in France is acquired by a legal entity and the name of the real owner is kept in secret.

When buying a new build property registration costs are about 25 of the transaction amount. The French taxe foncière is an annual property ownership tax which is payable in October every. Any person living abroad and owner of real estate in France is subject to French property tax.

The bill for the taxe foncière arrives in the last quarter of the year and the amount is based on the estimated annual rental value of the property multiplied by a percentage set by the commune ask for more information at your local mairie. Find out about the French tax household tax rates and allowances. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237.

Maintaining your property in France. In the overwhelming majority of departments the taxes amount to 580 of the purchase price. This will be anything from 410.

When buying property you can ask the estate agent immobilier or seller to give you details of the current tax payments. Discover our properties in French. A typical property purchase in France will incur combined charges from a notaire and estate agent of between ten and fifteen percent of the final purchase price.

Cut down on costs with Wise. They are not always up to date with their rates nor entirely comprehensive but the most reliable one can be found on the. Capital gains taxImpôt sur les.

17000 60000 1085. In French its known as droits de mutation or taxes de publicité. There is no exemption.

The Taxe Foncière is payable by property owners whether they live in the property or not. Here is how it is calculated. Be sure to budget for.

Other than their main home French residents pay capital gains tax on worldwide property at 19 plus surtaxes plus social charges which are generally 172 but can be reduced to 75 for Form S1 holders. French property tax for dummies. The notaire can advise you on the rate in your department.

Learn about property taxes for homeowners and renters. The costs involved in buying a property in France generally amount to between 7 and 10 of the value of the house for an older property and about 2 to 3 on a new builds. As noted above TVA is paid on new or off-plan properties but not on older properties.

Get the mid-market exchange rate when sending money overseas. These also include state duties taxes due diligence costs and the notary fee. Wait for the land registry cadastre notaire - the copy of the purchase deed should be sent to you between 2-6 months after the purchase.

There is also TVA to pay on. And get tax advice on your foreign earnings and investments. In total the sum of fees involved in buying the house cant exceed 10 of the propertys value.

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

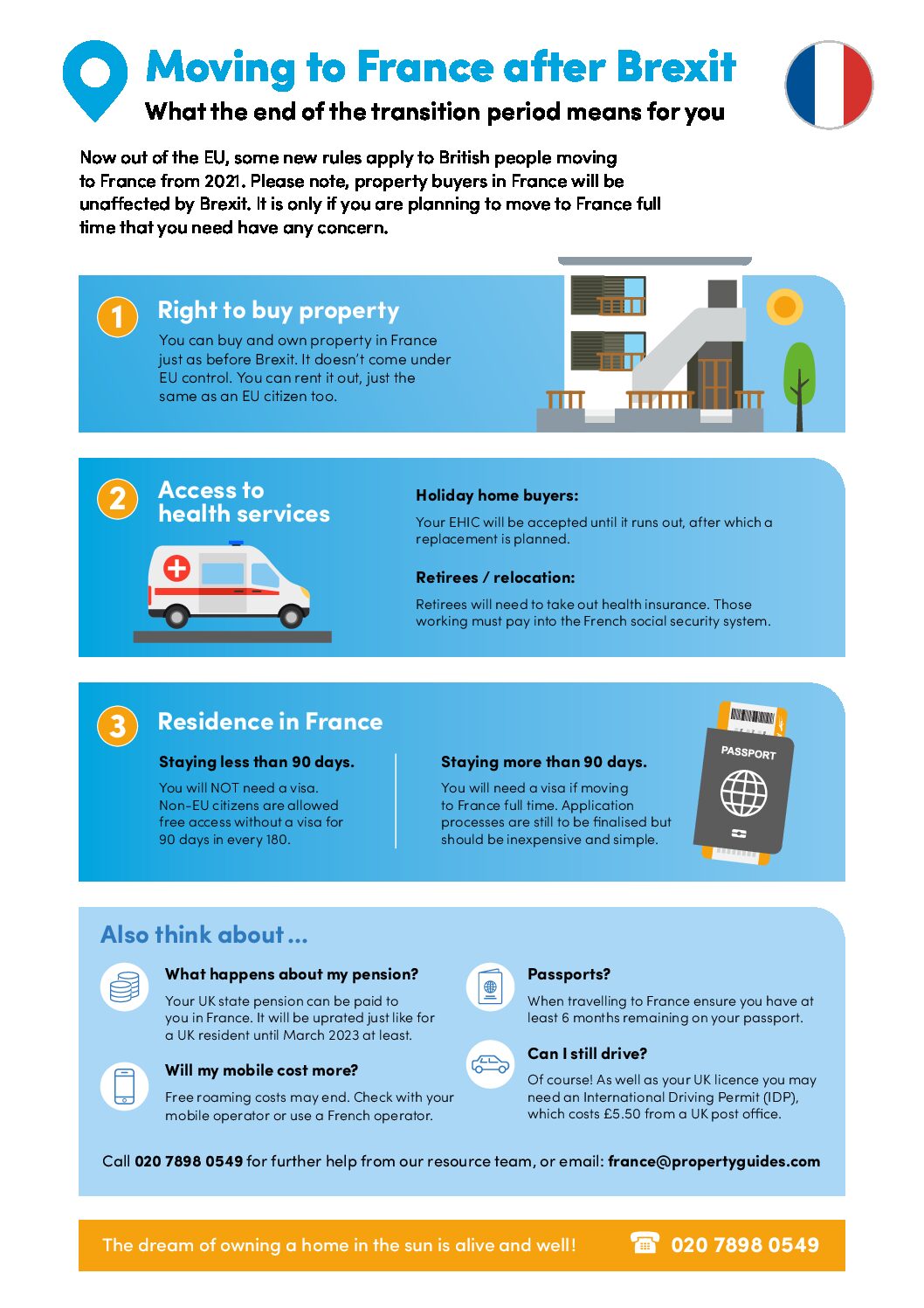

Buying Property In France After Brexit France Property Guides

Wherever You Go Real Estate Holds A Distinctive Role In Shaping Up A Country S Economy Directly Affecting The Buyers And Sellers In The Market There Are Some

In Depth Guide To French Property Taxes For Non Residents Expats

Taxation Tax Rulings In The Eu Map Taxes Europe Eu World Economic Forum Map Europe Map

How To Deal With A Tenant Who Is Not Paying Rent In France Buying Investment Property Real Estate Investment Fund Investing

Service After Sale The Houston Region To All Of My Buyers Request To Correct Name Or Address On A Real Property Accoun Harris County Tax Forms Accounting

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Account Property Tax Accounting Investors

Tax Implications For Foreign Nationals Buying Property In The U S New York Casas

How To Buy A House Or Property In France

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

French Property Tax Considerations Blevins Franks

Like Kind Exchanges Of Real Property Journal Of Accountancy

Euchre Deck Antique Paris France Euchre Gaming Tips Things To Come

How To Get A Resale Certificate In California Startingyourbusiness Com Resale California Certificate

Vat Charges And Buying Property No Agent Private Property Marketplace Buying Property Private Property Property